Budgeting Basics: Debt Snowball vs. Debt Avalanche

If you are looking into paying off debt, you have probably come across the terms “debt snowball” and “debt avalanche”.

These are two of the most popular methods to pay off debt. Honestly I don’t even know if there is another official way of paying off debt.

If there is one, I haven’t heard of it.

The Debt Snowball involves paying off your smallest debts first in order to see quick success and progress with your debt payoff plan.

The Debt Avalanche involves paying off the highest interest rate debts first in order to save the most money in the long run.

In my opinion, neither one is inherently right or wrong, it’s all about what is best for you and your situation.

So here is a breakdown of the debt snowball vs. debt avalanche method, so that you can choose which one to use for your debt free journey!

Debt Snowball

The debt snowball was made popular by Dave Ramsey, a name that most people have heard of whether you are part of the personal finance space or not.

He made this method to contrast the Debt Avalanche method. This is based primarily off of human behavior and the psychology of becoming debt free.

With the debt snowball, you pay off your smallest debt first. This means that you get quick satisfaction from seeing a 0 on your debts!

Dave Ramsey suggests this method based on the fact that most people in debt don’t have a math problem, they have a behavior problem. Therefore, this method provides quick reinforcement during your debt free journey. So you will keep up with paying off your debt fast!

Related: Why I Don’t Follow Dave Ramsey’s Baby Steps

Here are the steps for the debt snowball method:

Step 1: List out your debts from smallest to biggest. Note: this does NOT include your mortgage payment.

Step 2: List out the minimum payments due for each loan (this is the minimum that the loan provider requires that you pay each month).

Step 3: Pay the minimum payments on all of the loans.

Step 4: Throw any extra money at the first (smallest) loan. Dave would say this is where you attack your debt. In my opinion, put as much extra money as you want toward this loan. If you want to pay off your debt ASAP, then go full force. If you still want some of your luxuries, then you can take this journey slower if you want! Whatever works for you!

Step 5: Cross off your smallest debt once the balance is $0 (and throw yourself a little party! You did it!)

Step 6: Take the minimum payment amount from Debt 1 (that is now paid off) and add that to the minimum payment for Debt 2 (the one you are now going to tackle). Your new “minimum payment” for Debt 2 is those two amounts added together. If that sounds confusing, stick with me, it’s actually really simple.

Step 7: Repeat this process until you are debt free!

Related: How to Get a Month Ahead in Your Finances

Example of Debt Snowball

In this example above, my monthly minimum payments would be $505.

I would start by paying the minimum payments on all of the debt, and put any extra money toward the Target card with the lowest balance. My first couple of payments may look like this:

Payment 1: $600 (minimum payments + $95 extra toward Target Card)

Payment 2: $560 (minimum payments + $55 extra toward Target Card)

After those 2 payments, my Target card would be paid in full.

Note: In these examples I am rounding and not including interest charges, but you would need to take those into account as well. This is just to show the premise of the debt payoff method.

So now, instead of taking that $25 off of your monthly minimum payments, you are going to act like that payment is still there. So you will still pay $505/month as your “minimum payments”. Only now, that extra $25 will consistently go toward CC #1.

This is where the “snowball” idea comes in. You are “snowballing” that first minimum payment toward the second one, making a bigger “minimum payment”. This way, you pay off your debt faster all while keeping that minimum monthly amount you are putting toward debt (in this case, $505) the same throughout your debt payoff journey.

So your next few payments may look like this:

Payment 3: $800 (minimum payments ($505) + $295 toward CC #1)

Payment 4: $505 (maybe this month you didn’t have extra to put toward debt, so you are sticking with the minimum)

Payment 5: $635 (minimum payments ($505) + $130 toward CC #1)

Now your CC #1 would be paid off! You would continue to repeat the process until you paid off all of your loans.

Keep in mind, you will pay more over time with interest. In this example, your highest interest is actually CC #2, which will be the LAST debt you tackle because it is also the biggest debt.

So now that we have taken a look at the Debt Snowball, let’s look at the alternative option to paying off debt.

Related: 18 Ways to Save Money and Pay Off Debt

Debt Avalanche

For the Debt Avalanche Method, you prioritize paying off the debt with the highest interest rate while only paying the minimum payments on the rest of your debt.

This is a great method from a mathematical standpoint because, in the end, you pay way less interest than you might with the debt snowball method. Paying less interest also means that you will pay off your debt faster.

So you may be thinking, why would anyone NOT use this method? Fair.

But there is one major drawback to this method. It may take a long time before you see any concrete results from your debt payment plan.

With the Debt Avalanche, if your highest interest loan is also your biggest loan, it could take months or YEARS before you see your first $0 balance. This may be discouraging if you are new to your debt repayment journey.

It’s all about what is best for you.

So here is a breakdown of the Debt Avalanche Method:

Step 1: List out your debts from highest interest rate to lowest interest rate. Note: again, this does NOT include your mortgage payment.

Step 2: List out the minimum payments due for each loan (this is the minimum that the loan provider requires that you pay each month).

Step 3: Pay the minimum payments on all of the loans.

Step 4: Throw any extra money at the first (highest interest rate) loan. You choose if you want to go full force at attacking your debt, or if you still want to put some money toward spending.

Step 5: Cross off your first debt once the balance is $0 (and throw yourself a little party! You did it!)

Step 6: Take the minimum payment amount from Debt 1 (that is now paid off) and add that to the minimum payment for Debt 2 (the one you are now going to tackle). Your new “minimum payment” for Debt 2 is those two amounts added together.

Step 7: Repeat this process until you are debt free!

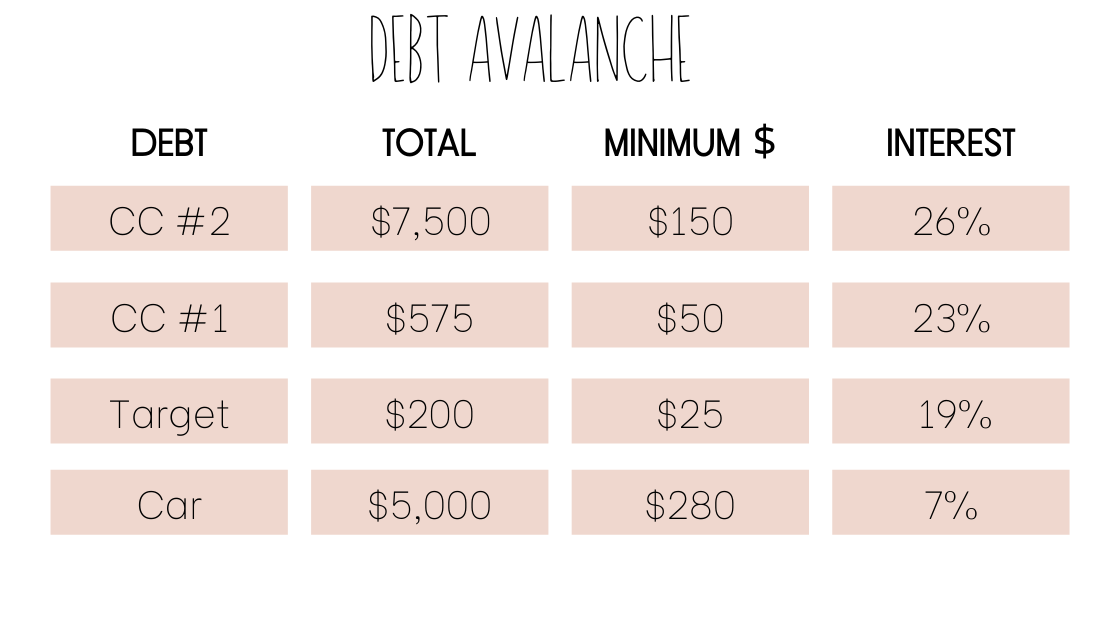

Example of a Debt Avalanche

In this example, we are working with the same debt, just in a different order. Our minimum payments would still be $505. We would throw anything extra at the first debt, which is now CC #2. Notice how our highest interest debt is also our largest debt.

This means that we will eventually end up paying less over time, and will get rid of that debt quicker, but we may have to wait a while before we pay off that first loan in full. Here is an example of what it might look like to pay off that first debt.

Payment 1: $805 (minimum payment + $300 extra)

Payment 2: $1000 (minimum payment + $495 extra)

Payment 3: $600 (minimum payment + $95 extra)

Payment 4: $1500 (minimum payment + $995 extra)

Payment 5: $1500 (minimum payment + $995 extra)

Payment 6: $2000 (minimum payment + $1495 extra)

Payment 7: $900 (minimum payment + $395 extra)

Payment 8: $1700 (minimum payment + $1195 extra)

Payment 9: $690 (minimum payment + $185 extra)

As you can see, in this example, it would take 9 months to pay off the first loan (this also doesn’t take into account interest, so it would actually take longer). That is a long time to wait to see any significant results in your debt free journey.

Therefore, it is important with this method that you can focus more on the big picture goal. If you are someone who needs to see those wins in the beginning, it may be worth it to do the Debt Snowball method instead.

Although, if you stick with it, you will pay off your debt much faster with the Debt Avalanche method!

Related: 8 Tips to Start Living Below Your Means

Which One is Best for You?

Ultimately, both of these methods have been proven to work for people time and time again. It all comes down to what is best for you and your specific situation.

You also can switch things up and incorporate both methods. If you start off with the Debt Avalanche and pay off your highest interest rate loan then notice you need some more motivation, switch to the Debt Snowball and get some more of those wins in!

You aren’t married to one of these methods, so make your budget and debt repayment plan work for you!

If you want to compare the difference between the two, you can use this debt payment calculator here. You don’t have to sign up or download anything, and it will show you a comparison between each debt payment method!

Here is the difference between the two methods using the numbers from above.

Debt Snowball:

Debt Avalanche:

*this is assuming you have $1000/month to throw at debt.

As you can see, with the Debt Avalanche Method you would pay $400 less in interest over time, but it would also take you 9 months to see your first $0 on one of your debts. Whereas with the Debt Snowball, it would only take you 2 months and you would have paid off TWO of your loans in full.

Let me know what you are using on your Debt Free Journey!

XO – Lexa